Safeguard customer data, streamline PCI compliance.

A credit card data breach can result in lasting brand damage and significant, long-term financial repercussions for an organization.

Delego’s portfolio of solutions, featuring its proprietary tokenization technology, protects cardholder data from inception, allowing a merchant to never process, transmit or store unsecured card data.

This approach allows for maximum PCI scope reduction, with the potential to reduce your SAQ to 26 questions.

Learn how we transform SAP into a hub for your electronic payments

Data Security

Delego Secure

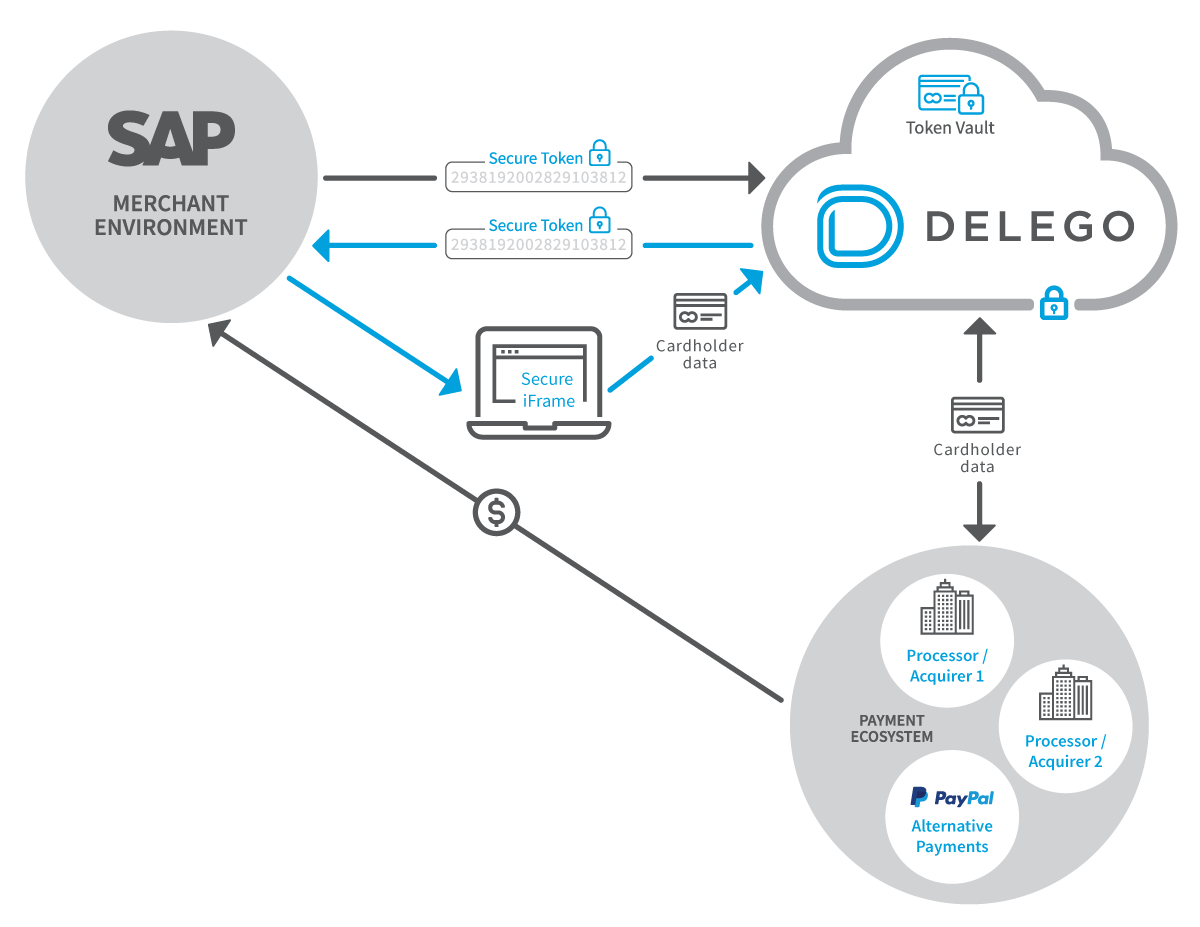

Delego Secure for SAP and Web intercepts sensitive card data before it enters your enterprise systems or applications and replaces it with a secure token.

Point-to-Point Encryption

Our PCI-validated P2PE solutions encrypt card data at inception, before it enters corporate work stations or traverses your network. Combined with tokenization, this solution provides end-to-end security and maximum PCI scope reduction.

3-D Secure

Expand globally and enhance security with 3-D Secure. Delego MPI is certified to enable both Verified by VISA and Mastercard SecureCode and seamlessly integrates to your webstore.

How tokenization works

Tokenization replaces a credit card number with a randomly generated alpha-numeric string which is used in its place.

Credit card data is transferred to our cloud where a corresponding token is created and stored in our token vault. The token is returned to the web store or SAP.

Get started

Unique and secure

Unlike encrypted data, Delego tokens cannot be reverse engineered to reveal the actual card number. Each token is unique to each primary account number and is never reused between merchants or saved in a shared database.